Heartwarming Tips About How To Handle Credit Collectors

Collectors can’t call you before 8 a.m.

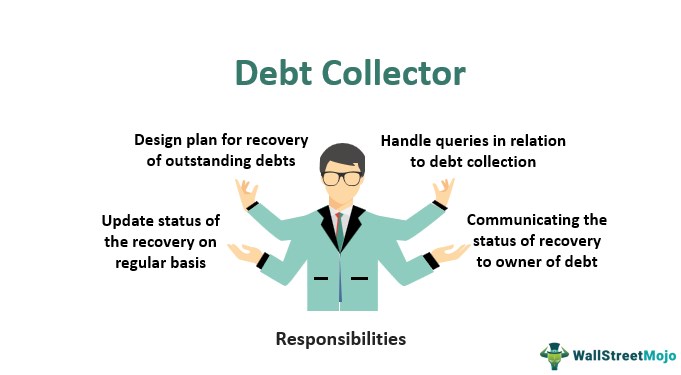

How to handle credit collectors. Payment history is the largest contributing. Check your records to make sure you haven’t already paid or settled the debt. This usually involves sending the debt.

Watch popular content from the following creators: Ask for a written summary of the. Any outstanding bill you haven’t paid can be sold or assigned to a debt collections agency.

Debt collectors must honor written. In your time zone, though they may send text messages or emails during that time. Collection agencies must wait 31 days before reporting any debt.

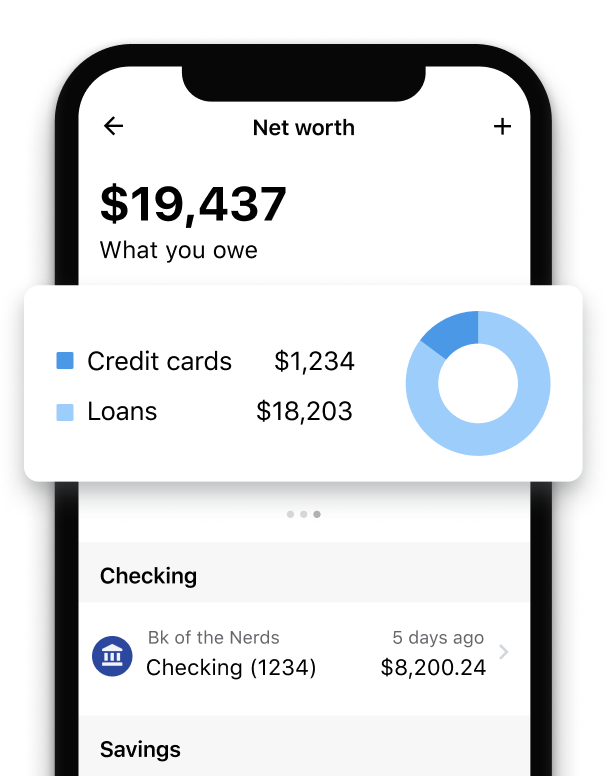

Avant could be a great choice if you have bad credit or a low credit score, and it can fund loans as soon as the next business day (if approved by 4:30 p.m. If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. No one wants to have debt collectors calling them all day long, but there are ways you can get them off your back.

A debt collector can contact you by phone, email, mail or text message when it's trying to collect payment for your overdue bills. Reporting is up to the collection agency’s discretion. Follow these tips to avoid making things worse with debt collectors:

If you can pay a delinquent bill before that 31st day, you can likely avoid damage to your credit score and credit. If you receive a notice that your creditor will transfer your debt to a collection agency, contact your creditor as soon as possible. Watch out for old debts.